SAP Business One and Amazon Integration.SAP Business One IPhone and IPad Videos.SAP Business One Consultants | Help With SAP Business One.Implementing SAP Business One – A Quick Intro.SAP Business One – On Premise and On Demand.Pay As You Go & Monthly Contract IT Support.In my subsequent postings on the subject matter, I’d concisely analyze the journal implications of each of these methods for sales, purchasing, inventory and production transactions. In this posting, I have only given an Overview of the costing methods in SAP Business One. However, it is important to note that continuous stock system cannot be deactivated after stock posting have been made. Different costing method can be defined for different items and you can change the costing system of your items globally. Good enough, SAP Business One allows so much flexibility as it relates to costing system. Thus, the choice of which of the costing method to use is a function of the objective to be achieved. And during goods release, the goods from the first layer (open) and their corresponding cost are used. This methodology ensures that when goods are received, a step-like arrangement or layer that is based on cost, quantities and entry date is created. FIFO: The FIFO inventory valuation method uses a “First- In- First Out” methodology.

A stock release posting on the hand, credits the stock account according to the standard price defined for the item. Very often than not, variance does occurs, thus the difference between the standard price and the receipt document price will be posted to a variance account. A stock receipt transaction that affects accounting debits the stock account based on the standard price defined for the item. The standard price method is advantageous in cases where you produce the items yourself. On stock receipt, it is not automatically updated. Standard Price: When standard price is used as the costing method, a static price is defined for each item.

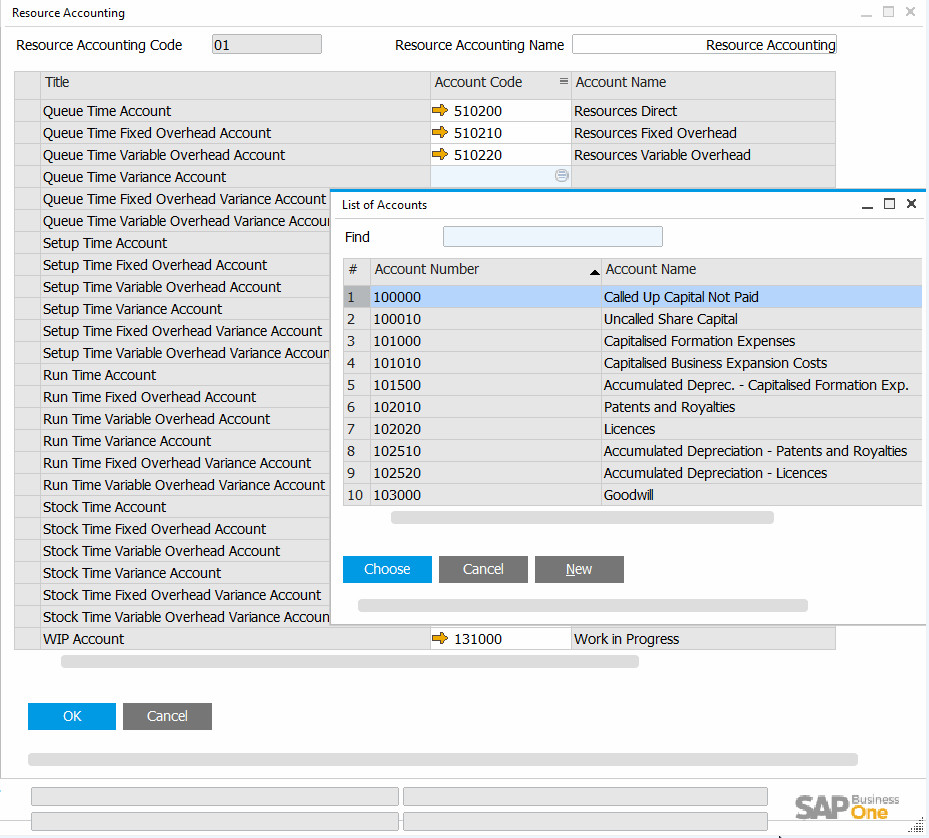

A stock receipt transaction that affects accounting, debits the stock account while a release transaction that affects accounting credits stock/sales return account based on the cost price of the item. On receipt of goods, the value is automatically updated. Moving Average: Inventory is valued using the cost price of the items. Irrespective of the costing method leveraged, prices are calculated in local currency. Continuous stock system is defined under: Administration > System Initialization > Company Details > Check default valuation method box (see figure below). The golden rule is that, continuous stock management must be activated before this functionality can be leveraged. SAP Business One supports only three types of costing or inventory valuation methods namely: Moving Average, FIFO and Standard Price. From the foregoing, it can be said that, inventory valuation is one of the metrics for determining the profitability of a business. Hence, it is a sensitive phenomenon because it impacts on your financial reports – Balance Sheet and Profit/Loss and even Tax reports. It has direct effect on the cost of sales, which is the summation of initial stock and inventory purchase less final stock. Inventory valuation is an integral part of a business, especially when stocks are involved.

0 kommentar(er)

0 kommentar(er)